Tax season doesn’t have to be a headache for travel nurses—it can actually be an opportunity!

From mileage to meals and even scrubs, your job's unique nature means plenty of deductions are waiting to lower your tax bill. But are you claiming everything you’re entitled to?

Let’s examine the deductions and ensure you keep every hard-earned dollar you deserve.

What's the difference between non-taxable and taxable income?

The distinction between non-taxable and taxable income is critical for travel nurses because it directly affects how much of their earnings are subject to federal and state income taxes.

Here’s a breakdown:

Taxable income

Taxable income includes any earnings the IRS requires you to report and pay taxes on your tax return.

For travel nurses, this typically includes:

1. Hourly wages or salary

The base hourly rate or salary you earn for your work is taxable. This amount is subject to federal, state, and sometimes local income taxes as well as Social Security and Medicare taxes.

2. Bonuses

Any signing, referral, or performance bonuses are taxable income.

3. Overtime pay

The additional overtime compensation is taxable if you work more than your contracted hours.

4. Reimbursements for non-work expenses

If you receive reimbursements for expenses not directly related to your assignment, such as personal travel or leisure expenses, those are taxable.

Non-taxable income

Non-taxable income refers to earnings not subject to income tax if specific criteria are met.

For travel nurses, this can include:

1. Housing stipends

Housing stipends are non-taxable if you maintain a permanent tax home and your travel assignment is temporary (typically less than a year).

The housing stipend becomes taxable if you don’t maintain a tax home.

2. Meal and incidentals allowance (per diem)

Per diem meals and incidentals are non-taxable if you meet the requirements for having a tax home and the assignment location is far enough from your tax home to necessitate lodging.

3. Travel reimbursements

Costs reimbursed for travel to and from assignments (e.g., airfare, mileage) are non-taxable, provided you’re traveling for work-related purposes.

4. Uniform or equipment reimbursements

If your agency reimburses you for scrubs, shoes, or work-related tools, these are typically non-taxable.

Understanding the difference between taxable and non-taxable income can help travel nurses maximize their take-home pay and remain compliant with tax laws.

Working with an experienced tax professional can ensure you're properly managing both types of income.

What can travel nurses claim as tax deductions?

Travel nurses can claim expenses to reduce their taxable income.

Here are those deductible expenses.

1. Travel expenses

If you drive your personal vehicle to a temporary job location, you can deduct the mileage at the standard IRS mileage rate (assuming your employer doesn’t reimburse you). Keep a mileage log with dates, destinations, and reasons for travel.

Travel between your tax home and temporary job site can be deductible if not covered or reimbursed by your employer.

2. Lodging and housing costs

Suppose you have a primary tax home and are temporarily reassigned (usually under a year) to a different location. In that case, you may be able to deduct lodging expenses not covered by your company.

Suppose you are paying a mortgage or rent on your primary tax home and paying rent or other housing expenses at your temporary assignment. In that case, the duplicate expenses may be deductible if the IRS requirements for temporary assignments and tax home status are met.

3. Meals and incidentals

If your travel nursing agency doesn’t provide meal stipends or covers them at a lower rate, you can claim actual meal expenses or the federal per diem for meals and incidentals while away from your tax home. Meal expenses are usually 50% limited.

Even for smaller amounts (under the IRS $75 threshold), it’s a good idea to document who was with you (if applicable) and the business purpose—especially if you want to be prepared for an audit.

4. Uniforms, scrubs, and equipment

Work clothes that your employer requires and that are not generally suitable for everyday wear (like hospital scrubs with a logo) can be deductible. If not reimbursed, laundry for those scrubs can also be deductible.

Stethoscopes, medical shoes, or other specialized tools purchased for your assignments can be deductible if used primarily for work and not reimbursed.

5. Professional expenses

When travel nurses file their taxes, they can deduct certain professional expenses from their taxable income if they’re ordinary and necessary for performing their job duties.

These expenses may include medical supplies and equipment, education and licensing fees, and other continuing education and professional development forms.

6. Equipment and medical supplies

Many travel nurses purchase and supply their equipment while on the job.

If your employer or contract doesn’t reimburse those expenses, you can deduct them from your taxes.

Common tax-deductible medical supplies include stethoscopes, blood pressure monitors, and other medical devices.

7. CE and licensing

Renewal fees for nursing licenses, additional state licenses, and certain certification costs can be deducted from your taxable income.

Also, courses and conferences related to your nursing profession that are required to maintain or improve your skills can be deducted.

8. Home office (less common)

If you work at home on administrative tasks (e.g., booking travel, reviewing charts, etc.) and use that area exclusively and regularly for your nursing business, you may qualify for a home office deduction.

Many travel nurses find their office-related work doesn’t meet strict IRS criteria, so consult a tax pro before claiming this deduction.

9. State-to-state considerations

Because travel nurses often work in multiple states, understanding each state’s tax rules is essential. You may need to file tax returns in more than one state, and each state can have unique guidelines for deducting travel, lodging, and meal costs.

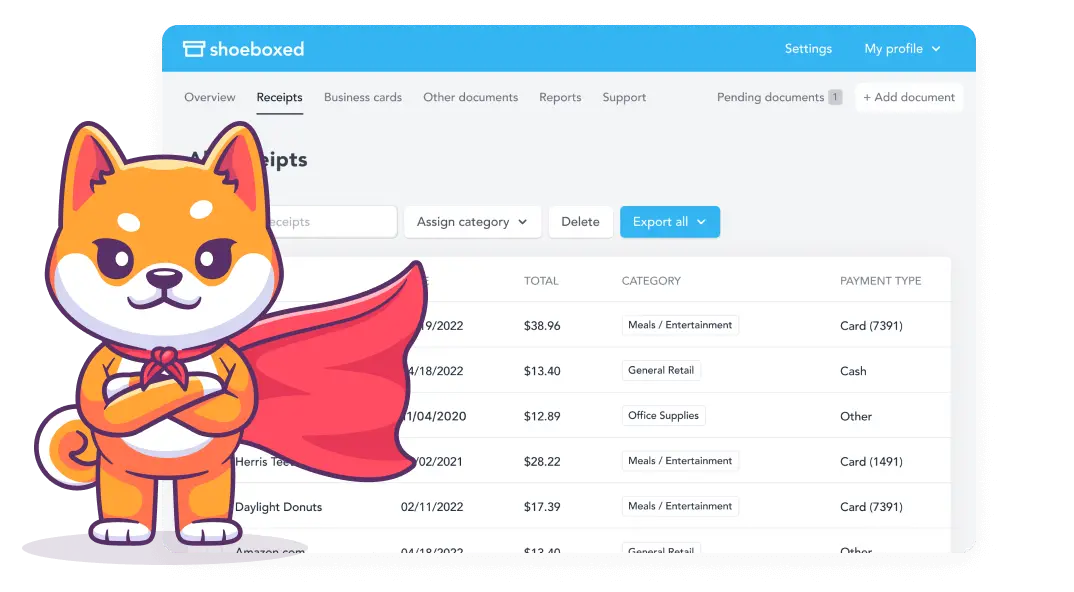

How can Shoeboxed help travel nurses claim deductions on their taxes?

Shoeboxed is an excellent tool for travel nurses to manage receipts and organize expenses so that deductions are all laid out and calculated at tax time.

Here’s how Shoeboxed can help.

1. Digitizes receipts and records

Travel nurses have many expenses (meals, lodging, mileage, work supplies, etc.) that can be tax deductible.

Shoeboxed allows you to upload and digitize receipts through the app or mail. Thus, you won't have to deal with having to keep up with or physical storage hassles to keep track of all your deductible expenses.

Instead of having to keep up with paper receipts, documents, and notes while on the road, Shoeboxed scans, uploads, and digitizes all your expenses. Simply scan the physical receipt with your phone's camera, and Shoeboxed's app will upload the digital version to your designated account.

Or, if you have a lot of receipts and don't want to scan them yourself, you can outsource them to Shoeboxed. Mail them via the free postage-paid Magic Envelope service, and they will scan, human-verify, and upload them to your designated account for you.

Shoeboxed is the only receipt scanner app that will handle both your paper receipts and your digital receipts—saving customers up to 9.2 hours per week from manual data entry!

2. Categorizes expenses

Shoeboxed’s OCR data extraction and categorization tools automatically label and sort business expenses by customized or tax categories. This simplifies your recordkeeping. Organized and categorized digital records mean you can be confident and prepared for tax season.

Shoeboxed can categorize expenses into IRS-compliant categories so you can quickly identify deductions for:

Temporary housing costs.

Mileage and travel expenses.

Licensing and certification fees.

Uniforms and other job-related purchases.

3. Tracks mileage

For travel nurses driving to assignments or between job locations, Shoeboxed has a mileage tracker. It records the details of each trip so you have accurate documentation for mileage deductions.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. 💪🏼 Try free for 30 days!

Get Started Today4. Generates detailed expense reports

Shoeboxed generates detailed expense reports with receipts attached with just a click of a button that can be shared with a tax professional. No more manual data compilation and no more errors.

All of your expenses are neatly laid out in transparent categories so that the numbers can just be transferred over to your tax return.

5. IRS-accepted documentation

Shoeboxed has IRS-compliant receipts and reports that can be used in case of an audit. Travel nurses can rest easily knowing their deductions are organized, categorized, and documented.

6. Tax season stress relief

By organizing all receipts and expenses throughout the year, Shoeboxed takes the stress out of tax season. Travel nurses can review their deductible expenses and file taxes with confidence.

Using Shoeboxed consistently will help travel nurses get the most out of their deductions and have all the documentation for tax purposes.

Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk.

Turn receipts into data for tax time ✨

Try Shoeboxed’s systematic award-winning approach to receipt tracking for tax season. Try free for 30 days!

Get Started TodayTravel nurse tips

Here are just a few tips to make taxes and your life as a travel nurse easier.

1. Maintain transparent documentation

The IRS is strict about claiming tax deductions, and as such, it requires proof of expenses, income, and receipts.

Keeping your documents current and organized with Shoeboxed helps with tax preparation and audits.

Keep receipts for all expenses, including travel, housing, meals, and medical supplies and equipment.

Keep a mileage log for vehicle travel.

Save receipts for significant or unreimbursed expenses.

Note the date, location, and business purpose for meals, lodging, or transportation.

2. Get help from a tax professional

Since every nurse is different—especially in tax home and multiple state work—work with a CPA or Enrolled Agent specializing in travel nurse taxes.

Tax preparation for travel nurses can get complicated.

A tax professional who has experience working with travel nurses can provide expert tax advice.

They can help you navigate the complexities of travel nurse taxes and ensure you take advantage of all available deductions and credits.

3. Stay prepared for audits

Although audits are rare, it’s essential to have documentation ready in case of an audit.

Keep financial paperwork for at least three to four years and comply with all IRS requests.

Hire a tax professional specializing in travel nursing to help you through the audit process.

Frequently asked questions

How do travel nurses reduce their taxable income?

Travel nurses can qualify for stipends, a type of non-taxable income.

Working in a state with no income tax along with tax deductions can also help lower your tax bill.

What are the most common income tax mistakes travel nurses make?

Not keeping proper documentation of expenses and income.

Not understanding the difference between non-taxable and taxable income.

Not consulting a tax professional who is experienced working with travel nurses.

In conclusion

Travel nurses love the flexibility and variety of working in different settings but have unique tax challenges in return.

By knowing what’s deductible, tracking work-related expenses, and meeting the IRS rules (especially the tax home rules), you can maximize your deductions and stay compliant.

If unsure, always consult a tax pro who specializes in travel healthcare.

Caryl Ramsey has years of experience assisting in bookkeeping, taxes, and customer service. She uses a variety of accounting software to set up client information, reconcile accounts, code expenses, run financial reports, and prepare tax returns. She is also experienced in setting up corporations with the State Corporation Commission and the IRS and is a contributing writer to SUCCESS magazine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!