As we rapidly approach 2024, independent contractors, business owners, and traveling employees are searching for ways to make their work lives more efficient.

A mileage tracker can be a lifesaver for those who travel for work and can be an effortless way to receive reimbursements or maximize tax write-offs for business mileage.

In this review and guide, we’ll hold QuickBooks’ mileage tracker to the fire to see if it’s all it’s cracked up to be. We’ll also share some alternatives to the QuickBooks mobile app so you can make an informed decision.

What are the key features of the QB mileage tracker?

QuickBooks’ mileage tracker page

Here’s a list of what the QuickBooks online mileage tracking feature offers.

1. Automatically track mileage

The QuickBooks tracker uses GPS for auto-tracking.

The app will track mileage automatically when you start driving, saving your trip data such as your start and end locations and times, the vehicle you’re driving, potential tax deductions, and the date.

If you don’t want to track personal trip mileage, you can toggle auto-tracking to “OFF” and manually log mileage data so you only track business mileage.

How do I manually record mileage in QuickBooks Online?

To manually record mileage on QuickBooks Online, log in to your QuickBooks Online account and click Expenses > Mileage > Add trip. Input the mileage information, including the date, start and end locations, purpose, and distance. Then, choose the vehicle you drove and save your drive.

How do I manually record mileage in the QuickBooks Online app?

You can manually record mileage in QuickBooks’ mobile app by selecting “Mileage” from the menu, tapping the plus (+) icon, and inputting the information from your drive. Click “Save” to manually log your trip.

2. Create mileage reports

Another popular feature is QuickBooks’ mileage reports.

These reports lay out all of your mileage data, including the following:

The dates for logged drives.

The vehicle you were driving.

Total miles driven.

Total business mileage.

Business usage percentage.

Total tax deduction.

You can quickly generate mileage reports right from the app and share them with your accountant or other tax professionals.

How do I get a mileage report from QuickBooks?

Downloading or exporting a mileage report from QuickBooks is a breeze and can be done in 5 or fewer steps.

Follow the steps below to get mileage for a particular tax year:

Go to “Reports.“

Click the drop-down arrow and select the tax year.

Click “View” to see that year’s mileage amounts.

Choose the email or download icon to export your mileage tracking information.

Follow the steps below to get all of your business miles:

Visit the “Miles” menu.

Click the Type drop-down arrow and choose “All.”

Click the Year drop-down arrow and choose “Custom date.”

Enter the dates and click “Apply.”

Choose the email or download icon to export your mileage logs.

You can download a mileage report using your QuickBooks Self-Employed or QuickBooks Online account either on your computer or through the QuickBooks Online mobile app.

3. Classify trips

After you’ve finished tracking mileage for a trip, the QuickBooks mileage tracker app saves a summary of your drive for you to classify.

For business trips, you’ll swipe the summary to the left. You can also add a business trip purpose to the drive, such as “Lunch with clients.”

4. Keep a digital mileage log

To claim mileage deductions, you must have a detailed record of your business mileage data.

When you track mileage with QuickBooks, you have 24/7 access to a digital mileage log that stores business mile data for the 3 years required by the IRS.

Digital mileage logs protect your interests should your business miles ever be questioned.

How much does the QuickBooks mileage tracker cost?

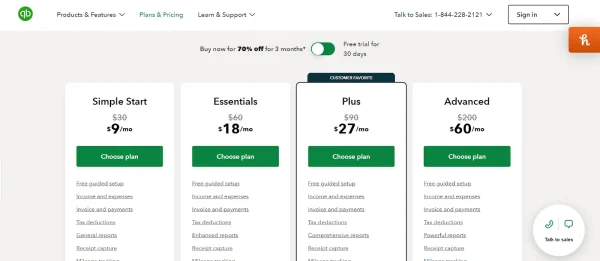

QuickBooks’ pricing tiers

The QuickBooks mileage tracker app can’t be used on its own. If you want the mileage tracker, you must purchase a package that includes QuickBooks’ other services.

If you only want to track mileage, QuickBooks can cost a pretty penny, too.

The Quickbooks online mobile app has 4 packages to choose from:

1. Simple Start

Price: $9/month for the first 3 months, then $30/month.

Features:

Mileage tracking.

Expense tracking and receipt capture.

Basic expense reports.

Get paid online.

Invoice and estimate creation.

Prepare and file 1099s.

1 sales channel connection.

2. Essentials

Price: $18/month for the first 3 months, then $60/month.

Features:

Everything in Simple Start +

Enhanced reports.

3 sales channels.

Up to 3 users.

Bill management.

Enter employee time to add to invoices.

3. Plus

Price: $27/month for the first 3 months, then $90/month.

Features:

Everything in the previous packages +

Comprehensive reports.

Connect all of your sales channels.

Up to 5 users.

Manage your inventory.

Track project profitability.

4. Advanced

Price: $60/month for the first 3 months, then $200/month.

Features:

Everything in the previous packages +

Up to 25 users.

Excel sync.

Employee expense submission.

Batch expenses and invoices.

Access controls.

Exclusive apps.

Workflow reminders and automation.

View version history and restore old data.

Automated revenue recognition.

All packages come with free guided setup and bookkeeping support.

Who can use the QuickBooks app?

The QuickBooks app comes free with your online subscription.

Though the app is free, remember that you cannot use it unless you already have a paid account.

QuickBooks’ Self-Employed mobile app can be downloaded on Android phones or any IOS mobile device.

Download on the Apple App Store.

Download on Google Play.

QuickBooks mileage tracker pros and cons

The QuickBooks mileage tracker pros and cons at a glance.

Pros

A complete solution for business expense management.

Mobile app and desktop versions.

The QuickBooks mobile app is modern and easy to navigate.

Track mileage automatically or manually.

Good for small business owners or independent contractors.

Easily classify business miles with a swipe left.

Add vehicles.

Leave a note with the purpose of the business trip.

Create and share detailed mileage reports.

Keeps a detailed log of your mileage in QuickBooks.

Cons

There may be more features than you bargained for.

Doesn’t show the route you (or employees) took, only the start and end points.

Auto-tracking also logs personal miles, which can be annoying if you only want to track mileage for business purposes.

A little pricy if you just want a mileage-tracking app.

Learn more about tracking your miles with QuickBooks in this video:

Tracking your miles with QuickBooks online

Other mileage-tracking apps

While QuickBooks offers a ton of features that many people (particularly business owners) can benefit from, it’s not for everyone.

Here are our favorite alternative mileage-tracking apps:

1. Shoeboxed – Best for receipt management

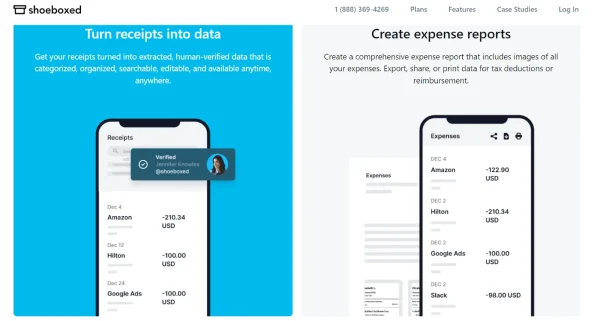

Turn receipts into data, track miles, and more with the Shoeboxed app

Shoeboxed is a receipt-scanning app and service that helps users manage their expenses and track their miles in preparation for tax season.

Shoeboxed offers a manual mileage tracker that logs your location, miles, and the route you take when out on a trip.

At the end of your drive, Shoeboxed will create a detailed trip summary with the date, editable drive name and mileage, and tax-deductible and rate.

After you approve the summary, the app will generate a receipt with the trip information that includes your route on the map.

Shoeboxed mileage tracking app

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 30-day full money-back guarantee!

Get Started TodaySo, what other features does Shoeboxed offer?

a. Receipt capture

If you or your employees often have to pay for business expenses such as parking or tolls, you’ll love Shoeboxed’s receipt capture.

Simply snap a picture of your receipt with the app, and Shoeboxed will automatically pull the information from the receipt and categorize it under one of the 15 editable tax categories.

The best part about the receipt capture feature is that it won’t interrupt your mileage tracker! Shoeboxed’s mileage tracker keeps tracking even when you have expenses to record.

b. Advanced search and tax preparation

With Shoeboxed’s advanced search and filters, you can find any receipt or business trip in seconds.

Want a detailed overview of this tax year’s mileage?

Just use Shoeboxed’s expense reporting feature to turn receipts into a comprehensive report for your accountant or employer.

Expense reports come with images of receipts attached should your business be audited or your reimbursement claims for expenses or mileage come into question by your employer.

c. The Magic Envelope

Shoeboxed’s Magic Envelope.

The Magic Envelope service lets Shoeboxed users outsource their receipt scanning.

When you sign up for a Magic Envelope plan, Shoeboxed will send you a monthly postage-pre-paid envelope to mail your receipts in.

Once your receipts reach the scanning facility, they’re digitized and uploaded to your Shoeboxed account under tax or custom categories.

Pros:

Manual mileage tracker so you can control the miles you track.

Trip details are editable, and you can leave notes describing the drive’s purpose.

Miles are turned into receipts for easy expense reporting and auto-categorized.

Search and filter options for effortless tax reporting.

Track mileage and digitize business receipts without stopping the tracker.

Expense reports have images of receipts attached for employee reimbursement or your accountant.

Integrates with accounting software, including QuickBooks, Xero, and Wave Accounting.

Magic Envelope service lets independent contractors or employers outsource receipt scanning for parking, tolls, and expense receipts.

Unlike QuickBooks, you can add unlimited free sub-users to your account.

In addition to receipts and miles, users can also keep digital records of business documents, such as business cards, licenses, and permits.

Paper receipts are mailed back to you unless you opt for shredding to reduce the paper waste in your home or office.

Cons:

There’s no way to automatically track mileage, but that makes it easier to separate personal from business trips.

Pricing:

Start Up – $22/month OR $18/month (billed annually) for unlimited users + Magic Envelope.

Professional – $45/month OR $36/month (billed annually) for unlimited users + Magic Envelope.

Business Plan – $67/month OR $54/month (billed annually) for unlimited users + Magic Envelope.

Starter Plan – $4.99/month for unlimited users (doesn’t include Magic Envelope).

Light Plan – $9.99/month for unlimited users (doesn’t include Magic Envelope).

Pro Plan – $19.99/month for unlimited users (doesn’t include Magic Envelope).

Visit Shoeboxed’s pricing page to learn more about the Magic Envelope plans.

NOTE: The first 3 plans are only available on desktop. The following plans are available on the Shoeboxed mobile app only.

Break free from manual data entry ✨

Use Shoeboxed’s Magic Envelope to ship off your receipts and get them back as scanned data in a private, secure cloud-based account. 📁 30-day full money-back guarantee!

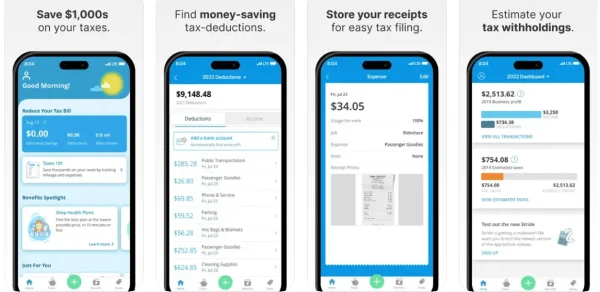

Get Started Today2. Stride – Best free mileage tracking app

Stride app, Apple App Store.

Whether you’re self-employed with a tight budget or still aren’t on the mileage tracker bandwagon, Stride is 100% free to use and offers promising features.

Though it isn’t an automatic mileage tracker, you’ll have everything you need to log your business miles effectively and capitalize on available tax deductions.

When you start the tracker, Stride records the time spent on the road along with your route and calculates the approximate tax deduction at the end of your drive.

This mileage tracker app also offers unique resources you won’t find in the other mileage trackers in our review, such as health, dental, vision, and life insurance resources.

A small business owner or independent contractor may find these help pages and Stride’s tax prep resources useful.

Stride also offers a receipt capture feature that can be used to track expenses. Whenever you photograph your business receipts, you can edit the job and expense and leave any relevant notes.

Pros:

Free expense and mileage tracking.

Excellent insurance resources for those paying out of pocket.

Estimates tax deductions on your trips.

You can link your bank account to receive write-off suggestions.

Mileage tracking starts with the click of a button. Manual tracking makes it easy to separate personal from business miles.

Cons:

Stride claims that its tracker logs miles automatically, though you must manually start and stop tracking.

The receipt capture is sub-par. Unlike Shoeboxed, it doesn’t automatically pull receipt information. You’ll have to enter the receipt details manually.

Pricing: Free.

3. Timeero – Best for time-tracking

Timeero mileage tracker app.

Timeero can be used to track billable hours and mileage, making it an excellent tool for independent contractors or business owners who bill their customers by the hour.

With Timeero, you can track your hours driving for business purposes, and if you have a team of drivers, you’ll especially benefit from the app’s employee management features, which include:

Managing users.

Keeping track of who’s working and when.

Managing jobs and tasks.

Tracking work hours and mileage for all of your employees.

Comprehensive mileage reports.

An overview of the time employees spend not working during work hours.

Timeero’s time tracker is a simple-to-use manual mileage log that allows users to take photos of the job site, restaurant, or other business stop they made and leave notes about the work or business purpose.

Pros:

Mileage reports.

Timeero tracks time and miles regardless of whether or not you have a stable connection.

Replay the routes you or your employees took.

Integrates with QuickBooks for accounting purposes.

A geofencing feature that alerts employers when employees leave a job site.

Add notes about the business purpose of your trip and take photos of the job site for future reference or proof for your employer.

Cons:

A better option for teams (employees) than individuals.

The cost can add up quickly depending on your plan and how many drivers you have.

Pricing:

Basic – $4/month per user.

Pro – $8/month per user.

Premium – $11/month per user.

4. TripLog – Best for automatic mileage tracking

TripLog mileage tracker.

What we really like about TripLog is that it offers not one but three auto-start options:

MagicTrip – Begins tracking 1-2 minutes after you start driving. Ends after 5 minutes of no motion detected.

Car Bluetooth – Automatically connects to your Bluetooth and tracks miles when your speed reaches 5+ MPH. The tracker stops logging your route when Bluetooth is disconnected.

Plug-N-Go – Tracker starts logging your route when you plug your phone into the car charger and reach a speed over 5 MPH. Tracking ends when you unplug your phone.

TripLog also has a receipt scanning feature for fuel and business expenses. If you don’t want to manually input expenses into your account, you can link your bank and card for auto-tracking.

NOTE: Only paid plans offer unlimited receipt uploads and drives, card and bank integration, and OCR scanning technology, so you’ll have to manually record receipt data.

With the free version, you get up to 40 expense uploads and drives per month.

Pros:

You can choose to track your miles automatically or manually.

Multiple auto-track options to choose from.

Receipt capture and automatic expense tracking.

Driver and route reports.

A web-based platform comes with the paid version.

Cons:

The free version only includes 40 expense uploads and drives per month.

You can’t integrate your bank and credit card with the free version.

No OCR scanning technology with the free version.

The receipt-scanning and expense-reporting features left much to be desired.

The app is dated.

TripLog can be costly for large teams.

Pricing:

Lite – Free version.

Premium – $5.99/month.

Teams – $10 per user/month.

Enterprise – $15 per user/month.

Track mileage with Shoeboxed 🚗

Track mileage using your phone’s built-in GPS for unmatched ease and accuracy. Expense reports don’t get easier than this! 💪🏼 30-day full money-back guarantee!

Get Started TodayFrequently asked questions

Does QuickBooks have a mileage tracker?

QuickBooks offers mileage tracking through its app. Users can turn on auto-tracking or manually input drives into their mileage logs. To enable auto-tracking, turn on automatic mileage tracking in the app and ensure your device allows QuickBooks to track your location.

What’s the best alternative to the QuickBooks mileage tracker?

Stride, MileIQ, Timeero, and Shoeboxed are among the best alternatives to tracking mileage with QuickBooks. With these apps, you can automatically track or manually enter mileage and claim the mileage tax deduction for less money than QuickBooks’ products.

Conclusion

Small businesses, employees, and independent contractors can all benefit from tracking mileage.

Tracking mileage in QuickBooks can be a great way to keep up with business miles for tax purposes or, as an employer, track your employees’ routes and properly reimburse them for expenses.

That said, QuickBooks can be costly and may offer more features than you need or want. In that case, Shoeboxed, Stride, and Timeero are our top choices for QuickBooks alternatives.

Hannah DeMoss is a staff writer for Shoeboxed covering organization and digitization tips for small business owners. Her favorite organization hack is labeling everything in her kitchen cabinets, and she can’t live without her mini label maker machine.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports that include IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports and more—with Shoeboxed.

Try Shoeboxed today!