As one of the most used budgeting methods for business, activity-based budgeting is popular amongst many businesses.

If you are new or want to control your business expenses, you have come to the right place.

What is activity-based budgeting?

An activity-based budgeting company tracks, organizes, and analyzes expenses to identify cost-saving areas. Based on your findings, you can create a better budget.

Why use activity-based budgeting?

Businesses that use activity-based budgeting, ABB, reduce unnecessary expenses and shift the focus from traditional and other strategic budgeting methods to prioritizing essential activities and investments first. It allows them to:

Become familiar with every associated cost

Find ways to reduce and better manage expenses

Rather than using past budgeting, it uses this data to help you better align your budget with your business’s goals.

It can also boost productivity, gain a competitive advantage, and improve efficiency.

How to use activity-based budgeting for your business

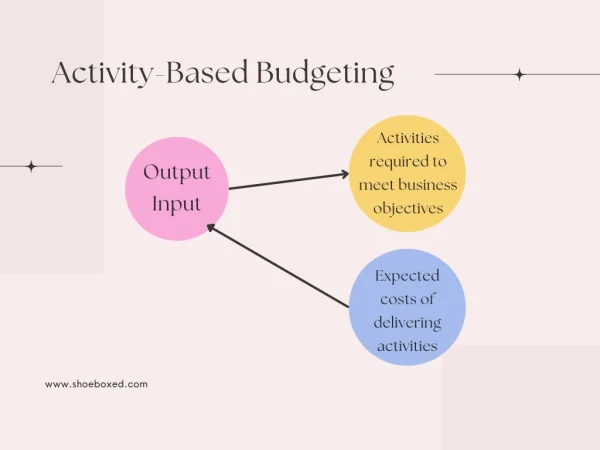

As part of business management, keeping costs to a minimum is crucial. Activity-based budgeting (ABB) can be broken down into 3 parts:

1. Identify relevant business activities.

Look into all business expenses and their activities in the entire organization.

Once identified, you can see which activity drives up costs more than the others. While easier said than done, thoroughly reviewing and analyzing each expense will justify cost cuts.

You can create a base budget and implement changes to reduce overall costs.

Shoeboxed

Use Shoeboxed to help you organize your relevant business activities through your receipts.

Scanned receipts will be categorized and stored on the cloud for easy access. At the same time, you can track your expenses and keep accurate records for activity-based budgeting.

Most Business Owners & Contractors Miss This $1,500+ Tax Deduction. Will you? 💰

Work from a home office? Even a few hours a week or month? If you make your money as a contractor or own your own business, you may be able to save big on taxes. Many 1099 & Schedule C filers can save $500 - $2,000 or more. Take our 4 question quiz to get your PERSONALIZED tax savings estimate.

Digitize your receipts

Shoeboxes use OCR, optical character recognition, and technology to help you manage, organize, and process all your receipts.

With OCR, it quickly automatically categorizes your receipts and creates accurate expense reports.

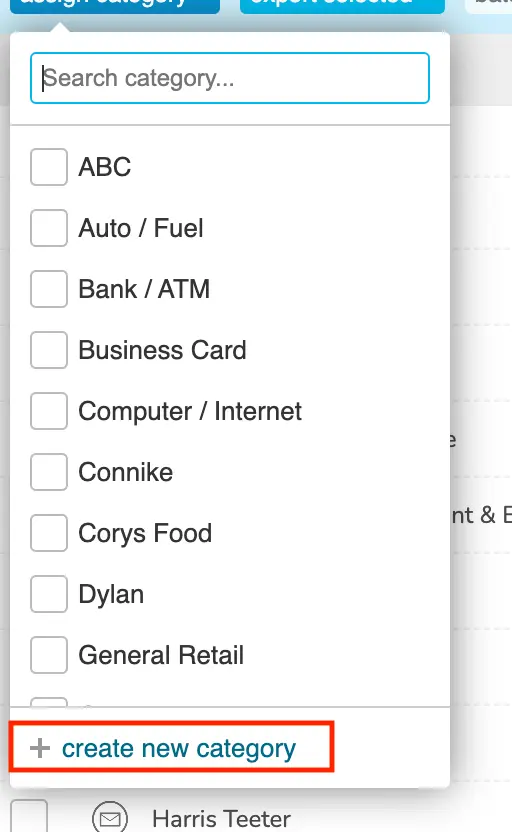

Automatic categorization

Shoeboxed's algorithm can determine whether a receipt fits into one of 15 default categories based on the vendor's name.

However, if these categories do not help you identify your business activities, you can add your own to improve your identification.

Various ways to track receipts with ease

Shoeboxed allows your business and employees to scan receipts using a mobile app, email, or even postal mail.

Scanning the receipt is the easiest for those who are always on the go. Email is great for sending a couple of receipts.

Shoeboxed's Magic Envelope is perfect for those who don't want to bother with manual scanning.

Most Business Owners & Contractors Miss This $1,500+ Tax Deduction. Will you? 💰

Work from a home office? Even a few hours a week or month? If you make your money as a contractor or own your own business, you may be able to save big on taxes. Many 1099 & Schedule C filers can save $500 - $2,000 or more. Take our 4 question quiz to get your PERSONALIZED tax savings estimate.

2. Assess baseline costs for each activity.

At this step, it's important to identify cost drivers—factors that increase or decrease costs. So you can calculate the number of units related to each activity.

An example of a unit are:

Number of line workers

Number of staff

Number of vehicles

Another way to consider this step is the number of people doing specific work within several hours.

By identifying these, you can pinpoint the business processes driving your expenses, which will help your strategic planning to activity-based budgeting.

3. Calculate the cost per unit.

By calculating the cost per unit for each activity, you can build a better and more accurate budget.

A simplified example would be if labor costs $12 per hour. That number is multiplied by the unit cost to calculate the total cost. So if it takes 100 hours, the total costs would be $1,200 (100 x $12).

This method allows you to allocate resources based on the expected activity level and project the total costs of each activity.

If there are other changes, you should recalculate the cost per unit and compare it with the baseline to see if there are any budget impacts.

Activity-based budgeting example

Let’s use activity-based budgeting (ABB) to break down a candle business's key activities, cost drivers, and cost per unit.

Key activities |

Cost drivers |

Cost per units |

Making candles |

Number of candles produced |

$5 in materials and labor |

Packaging products |

Numbers of boxed packed |

$2 per box and packing cushions |

Shipping orders |

Numbers of orders shipped |

$10 per shipping order |

If the business wants to make 1,000 candles, buy 1,000 boxes, and ship 500 orders, the budget will be $12,000 ($5,000 for production, $2,000 for packaging, and $5,000 for shipping).

With this simplified breakdown, you can see where each resource was allocated and find ways to optimize costs, such as reducing packing costs or improving shipping rates.

Compare that with a more traditional budgeting method, knowing if there’s more candle demand. The business predicts it will make 1,200 candles. So, they may allocate $10,000 for candle-making materials and $5,000 for labor, but that can lead to overspending or fund misallocations.

So, with ABB, you can recalculate the costs based on current business levels, making it a better and more flexible budgeting process.

What are the advantages and disadvantages of activity-based budgeting?

Advantages of ABB

ABB, activity-based budgeting, is great for those looking at exactly what each cost is associated with on an operational level. ABB can also:

Better accuracy: by breaking down activities and cost drivers, you can have a more precise budget

Improved resource allocation: ABB ensures that specific resources are allocated efficiently and aligned with business priorities and strategic objectives.

Cost reduction opportunities: Identify inefficiencies, unnecessary costs, and areas for process improvement, making it easier to optimize spending.

Disadvantages of ABB

While activity-based budgeting is a great budgeting method, there are a couple of disadvantages to be aware of:

Analysis complexity: Breaking down activities and cost drivers can be time-consuming and challenging, especially for organizations with numerous or interdependent activities.

Resource-intensive: The overall process of identifying, analyzing, and tracking costs, along with any additional tools, can increase administrative overhead.

Resistance to change: Shifting to ABB from traditional budgeting can be met with resistance from employees or management accustomed to the simpler, less detailed traditional approach.

Activity-based budgeting vs other budgeting methods

Here is a quick summary table of other budgeting methods compared to activity-based ABB budgeting.

Features |

Activity-Based Budgeting (ABB) |

Zero-Based Budgeting (ZBB) |

Incremental Budgeting (IB) |

Focus |

Allocates costs based on specific activities and cost drivers. |

Start from zero; every expense must be justified. |

Adjusts the previous budget by a fixed increment. |

Detail Level |

High; requires analyzing activities and their costs. |

Very high; justifies all costs regardless of prior use. |

Low: focuses on overall adjustments without detail. |

Flexibility |

Highly adaptable to changing activity levels. |

It is adaptable but can be time-consuming to implement. |

Limited; relies on past budgets and fixed changes. |

Efficiency |

Highlights inefficiencies and opportunities to reduce costs. |

Encourages scrutiny of all expenses to eliminate waste. |

May perpetuate inefficiencies from past budgets. |

Best For |

Organizations with varied and detailed activities. |

Organizations need a fresh perspective on costs. |

Stable businesses with predictable costs. |

Who is activity-based budgeting for?

Activity-based budgeting (ABB) is ideal for businesses looking for a detailed and accurate approach to financial planning. It is particularly recommended for:

New companies without historical budgeting data: ABB helps establish a clear baseline by analyzing activities and cost drivers, even without past budgets.

Industries requiring precision: ABB benefits major industries like manufacturing, construction, and healthcare due to their complex operations and need for accurate cost allocation.

Companies undergoing significant changes: ABB is highly effective for businesses navigating transitions, such as introducing new subsidiaries, large clients, business locations, or product lines.

In closing

Activity-based budgeting (ABB) is a more precise and strategic approach to business financial planning. It improves resource allocation, reduces costs, and aligns finance with strategic objectives. Whether you’re a new business or an established company changing, ABB can help you build a more efficient and adaptable budgeting process.

Tammy Dang is a staff writer for Shoeboxed covering productivity, organization, and digitization how-to guides for the home and office. Her favorite organization tip is “1-in-1-out.” And her favorite app for managing writers and deadlines is Monday.com.

About Shoeboxed!

Shoeboxed is a receipt scanning service with receipt management software that supports multiple methods for receipt capture: send, scan, upload, forward, and more!

You can stuff your receipts into one of our Magic Envelopes (prepaid postage within the US). Use our receipt tracker + receipt scanner app (iPhone, iPad, and Android) to snap a picture while on the go. Auto-import receipts from Gmail. Or forward a receipt to your designated Shoeboxed email address.

Turn your receipts into data and deductibles with our expense reports, including IRS-accepted receipt images.

Join over 1 million businesses scanning & organizing receipts, creating expense reports, and more—with Shoeboxed.

Try Shoeboxed today!